What Will You Do When the Bubble Pops?

We hesitated a LOT before deciding to share the information below.

After all, we cannot legally provide investing advice (let’s say it once and for all: none of what follows is investing advice. We don’t recommend buying or selling anything in particular).

But we feel that if we have solid information, we need to share it with our beloved community.

We see our mission as educating, facilitating, connecting, nurturing, as well as protecting.

If you have the patience to read what follows, you could save 1,000s or 10,000s or 100,000s of dollars.

You could shave years of unnecessary work before you retire.

Here we go.

We are entering bubble territory. Some readers may never have lived through a bubble. Others may have experienced the dot-com bubble around 2000 (when the Nasdaq crashed almost 80%), or the real estate bubble around 2008 (when the S&P 500 fell 60%).

Sadly, our collective memory tends to be short, so we forget how painful it is to watch your portfolio hemorrhaging, acutely bleeding to death, until it flatlines.

Sure, “people” will encourage you not to time the market. They will tell you cannot. To be clear, we agree.

“People” will tell you to be a buy-and-hold investor. And we agree – to a degree.

“People” will tell you that cash is the devil because it earns close to 0% (or a negative rate if you take inflation into account).

This reminds us of colleagues who tell owners of a pet with a mass to “just watch it.” So guess what, they watch it! They watch it grow and grow and grow, and don’t do a thing about it until it’s too late.

It’s the same when a bubble pops. Investors who drank the Kool-Aid pride themselves in mastering their emotions. They are buy-and-hold investors after all. They won’t panic-sell.

Don’t watch your portfolio wither away without doing anything! Start CPR before it’s too late!

Before we share what you can and should do when the bubble pops, we’d like to share a recent “investor letter” written by Jeremy Grantham, co-founder of GMO.

GMO, or Grantham, Mayo, & van Otterloo, is a well-known Boston-based asset management firm with well over $100 billion in assets under management. Grantham is a very well-respected financial genius. Here is the beginning of his “letter:”

(The emphasis is ours – at least read that one sentence if you don’t want to read the whole quote!)

“The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.

These great bubbles are where fortunes are made and lost – and where investors truly prove their mettle. For positioning a portfolio to avoid the worst pain of a major bubble breaking is likely the most difficult part. Every career incentive in the industry and every fault of individual human psychology will work toward sucking investors in.

But this bubble will burst in due time, no matter how hard the Fed tries to support it, with consequent damaging effects on the economy and on portfolios. Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives. Speaking as an old student and historian of markets, it is intellectually exciting and terrifying at the same time. It is a privilege to ride through a market like this one more time.”

So why do we keep talking about a bubble?

Here are a few facts we keep talking about – or joking about – in our private Vet Financial Summit community.

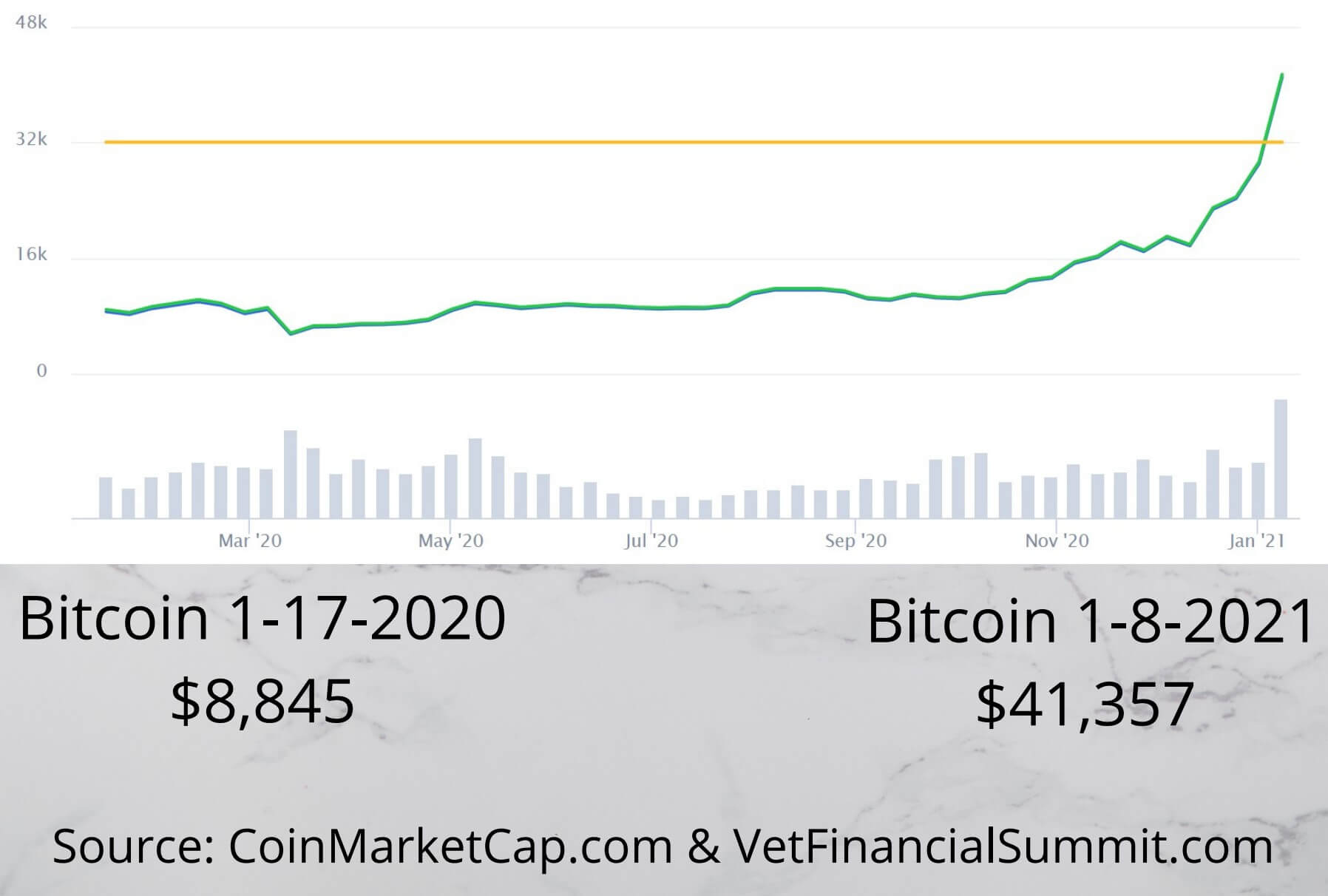

- Bitcoin is back into stratospheric explosion. It doesn’t matter if you own some Bitcoin or not. Here are the facts-in-a-graphic.

This is what a bubble looks like.

- Tesla, the maker of electric cars, is in a classic bubble. Based on data from Yahoo Finance, Tesla’s valuation or market capitalization ($830 billion as of this writing, early 2021) is more than the “market cap” of the 10 the next biggest car companies COMBINED.

Toyota, Volkswagen, Daimler, General Motors, BMW, Hyundai, Ferrari, Honda, Fiat, Chrysler and Ford have a combined market cap under $738 billion.

This is what a bubble looks like.

Even Tesla’s CEO, Elon Musk, posted on Twitter in May of 2020 – when the stock price was much lower: “Tesla stock price is too high.”

Let’s look at Toyota. It sold more cars in 2020 than Tesla did.

Toyota has a yield of 2.7%. Of course, Tesla doesn’t pay a dividend.

In 2020, Toyota made $13 billion. Tesla lost $862 million. Actually, Tesla has never made a profit!

Does that make any logical sense?

If it does, then by all means, keep buying!

If it doesn’t, then observe what follows as typical bubble behavior. What goes up must come down. The only question is when…

- The Dow Jones recently broke through the psychological barrier 30,000 mark for the first time in history. It recovered from its March lows, then increased over 60% in 2020. That’s what a bubble looks like.

So assuming you believe we’re in a bubble, and that it will eventually pop, what should you do? Did we mention we can’t give you stock advice?

Nevertheless, here are some general suggestions.

- Set up stops, and watch them like a hawk.

- Going hand in hand with using stops, respect proper position-sizing.

In other words, if you invest 50% of your portfolio in a particular stock or fund because you believe in it, and it crashes when the bubble pops, this could cause you a world of pain. It could push your retirement much further into the future.

However, if you never invest more than 4% to 5% of your portfolio in any single investment, you will not risk losing it all when things go south.

- Consider buying tangible assets (as opposed to paper assets) that are not correlated to stocks and will hold value over time: gold, silver, real estate.

- Consider going to cash. It’s better to earn 0% for a while, than to lose 20, 40 or 60% of your portfolio. And it’s a good idea to have some “dry powder” so you can go on a buying spree after prices crater.

Bottom line: the bubble will pop when you expect it the least. It always does. Nobody can tell you when it will happen. But it’s just a matter of time. Please don’t be greedy. Be protective of your hard-earned money.

Phil Zeltzman, DVM, DACVS

Meredith Jones, DVM

Co-Founders of Veterinary Financial Summit

Interested in learning more about $$$?

Subscribe to the Blog

Join the Community

Attend the Summit

Learn about the Mastermind