The Richest Vet in Babylon

Pop quiz: when was the best-selling book “The Richest Man in Babylon?” written? 2000? 1990? 1980? 1970? 1960?

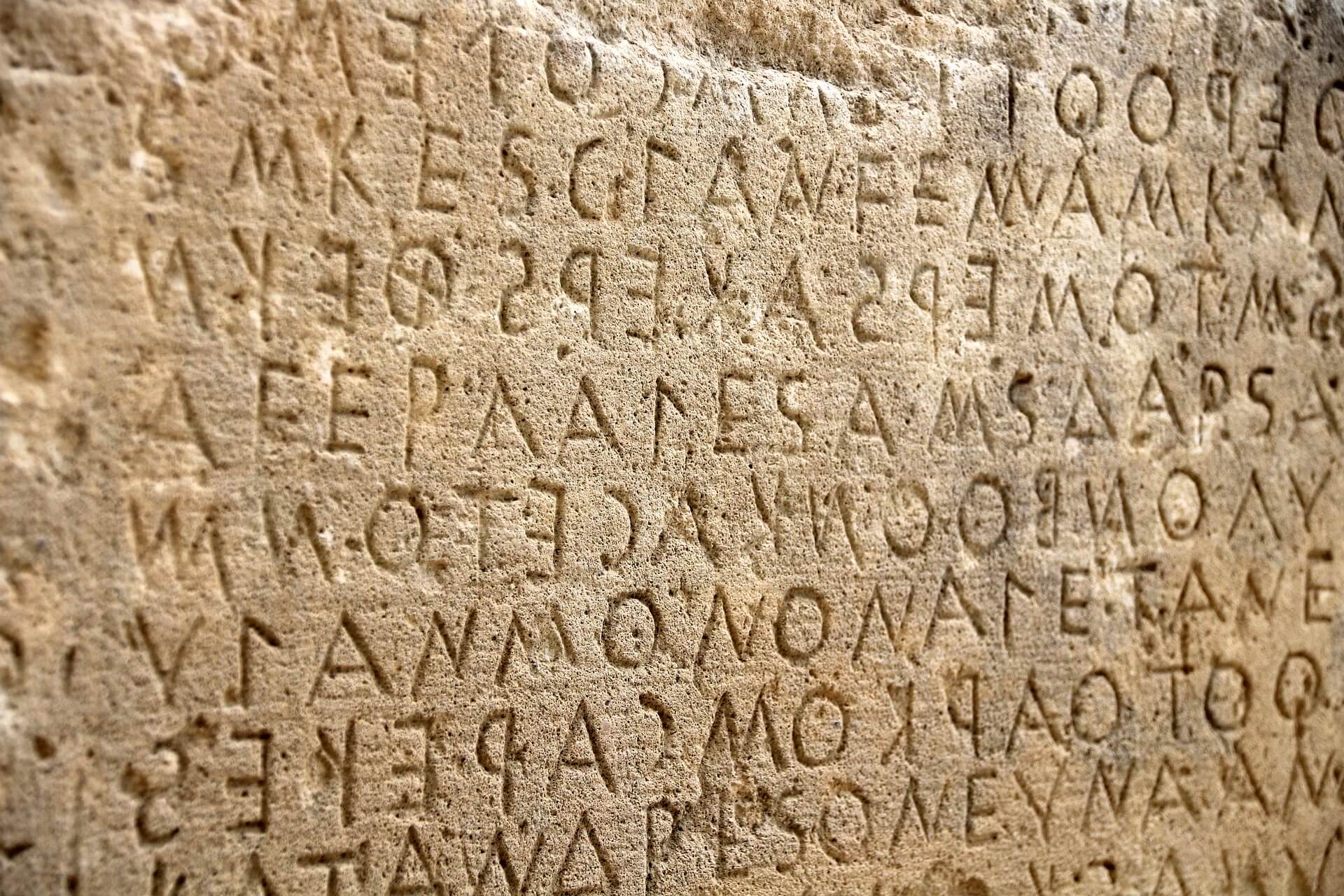

You may have heard this ultra-classic title multiple times. Did you think it was a semi-contemporary book? Not so. It was first published in 1926!

Back then, George Clason wrote a series of pamphlets on financial topics, using parables set in ancient Babylon. They were initially distributed by banks and insurance companies. The pamphlets were eventually published in book form in 1926. The most famous story was “The Richest Man in Babylon,” and it is as relevant today as it was then.

Arkad was a young, hard-working scribe – a professional copyist. As he was wondering how he could become financially independent, he met Algamish, the money lender. Young Arkad boldly asked him what his secret was, and Algamish accepted to share it.

His secret? “A part of all you earn is yours to keep.”

This secret surprised Arkad, who thought that all he earned was already his to keep. Far from it, replied Algamish. “Do you not pay the garment maker? Do you not pay the sandal maker? Do you not pay for the things you eat? Can you live in Babylon without spending? What have you to show for your earnings of the past month? What for the past year? You pay everyone but yourself.”

He goes on to suggest that Arkad keeps for himself one-tenth of all he earns – and no matter how little or how much he earned.

This is what every modern personal finance book translates as “pay yourself first” and “save 10% of your gross income.”

Other lessons from the book include:

Arkad’s friends worried that if everybody were wealthy, there wouldn’t be enough gold for everyone. Nonsense, replied Arkad. “If a rich man builds a new palace, is the gold he pays out gone? No, the brick maker has part of it, and the laborer has part of it, and the artist has part of it, and everyone who labors upon the house has part of it.”

Modern translation: MacMansions benefit a lot of people in the construction industry (and banking, insurance, landscaping etc). (Please note: we are not advocating you go out and buy a MacMansion… but you get the point!)

- When Arkad entrusted the money he saved to Azmur, the brick maker, who bought rare jewels (which turned out to be fake) from the Phoenicians, he lost his shirt. Modern translation: don’t trust your brother-in-law or your hairdresser with your investments.

- When Arkad used the interest from his savings to enjoy a lavish lifestyle, he was essentially destroying his wealth. Modern translation: interests (or dividends) generate more interests (or dividends), which generate more interests (or dividends). This is the power of compounding.

George Clason’s wisdom hasn’t changed a bit in almost 100 years. Without any question, the biggest lesson of the book, and sadly least understood and followed, is: “A part of all you earn is yours to keep.”

You may want to follow Arkad’s lead on this one if you ever want a shot at becoming the richest vet (or nurse) (or manager) in Babylon.

Phil Zeltzman, DVM, DACVS

Meredith Jones, DVM

Co-Founders of Veterinary Financial Summit

Interested in learning more about $$$?

Subscribe to the Blog

Join the Community

Attend the Summit

Learn about the Mastermind