The 4 Stages of Your Financial Life

There are several ways to look at your financial stages along your career.

What follows is one way to look at your financial life, based on a concept borrowed from Mike Hollister, CPA at investment firm Nexpoint, based in Dallas.

Please keep in mind that the age ranges and phases are somewhat arbitrary. It’s the concept that matters, more than the absolute numbers. Remember, personal finance is personal, so your situation will likely differ from this framework.

1. The budgeting years

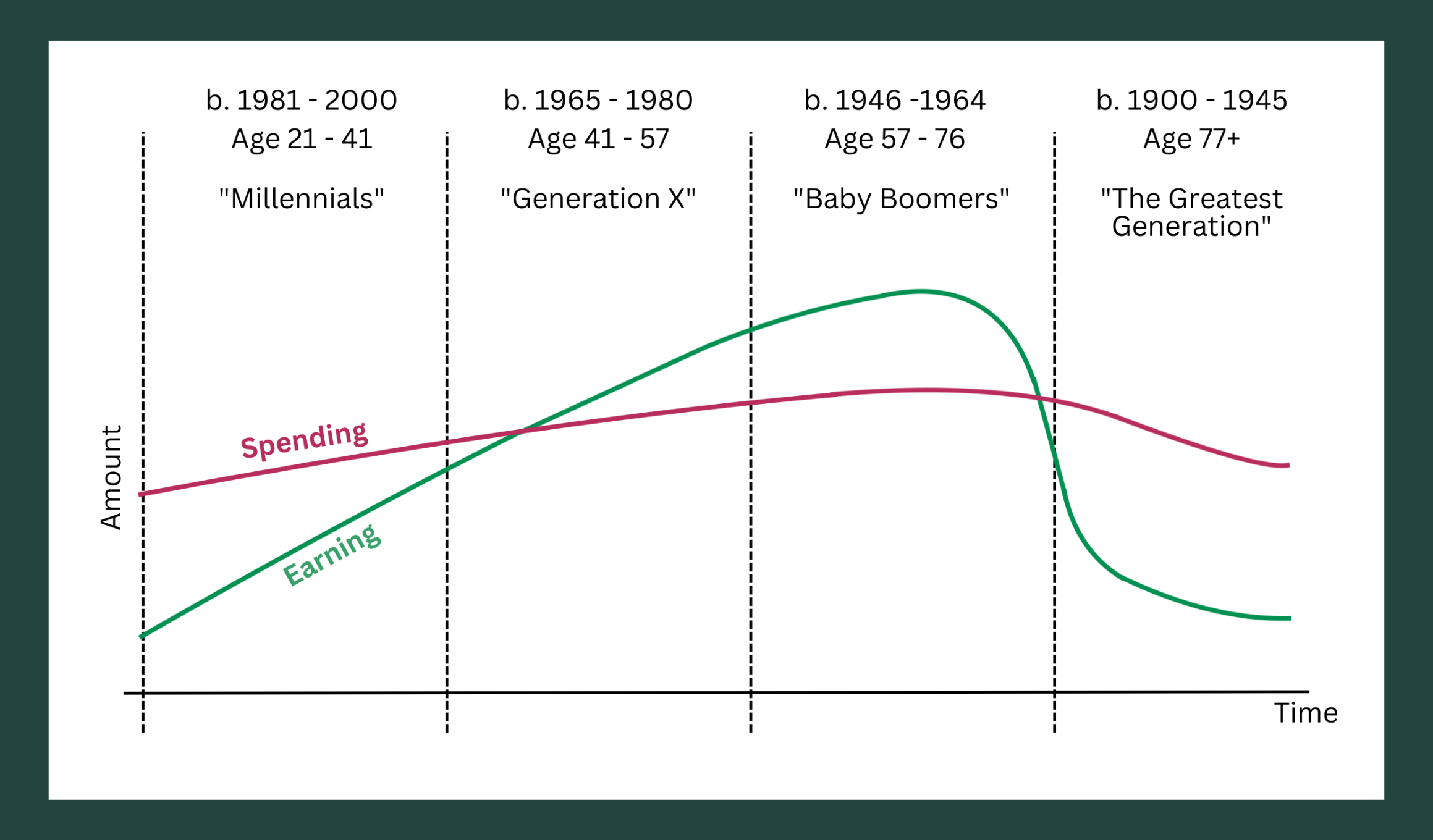

Roughly between the ages of 21 and 41, we typically spend more than we make, as shown in the first part of the curve. This mostly affects millennials, born before 2000.

Right after college, their income is unlikely to cover their living expenses + a monthly car payment + a house down payment + a monthly house payment + possibly student debt. And hopefully, they don’t get into consumer debt…

Then at some point, there may be a wedding, and a honeymoon, and kids… compounding the issue…

Most often, the parents bear the responsibility of financial education: healthy financial habits, budgeting, saving, building up an emergency fund, paying down debt, maximizing income, improving their credit score, and yes, investing as early as possible.

And none of that is possible without basic financial education, so they should dedicate some time to that as well.

During the budgeting years, you usually have more time and stamina than money, hence the idea of sweat equity. Time is an asset. It’s likely acceptable to take a bit more risk than in later years, since you have time to recoup money lost from poor investment choices.

2. The accumulating years

Roughly between the ages of 41 and 57, we reach the accumulating years.

This mostly affects Generation Xers, born between 1965 and 1980.

After years of working, saving, and repaying debt, the curves (hopefully) slowly reverse: income streams progressively become larger than the debt burden.

By now, there should be an established emergency fund. Debt should be significantly lower. Depending on the situation, helping put kids through college is over. So you can focus more on your financial wellness, your exit strategy & your golden years.

Your main focus is usually wealth accumulation or growth.

During the accumulating years, you typically have less time and a bit more money. Time is still on your side, so slightly riskier investments in a portion of your portfolio are still acceptable.

3. The managing years

Roughly between the ages of 57 and 76, we reach our peak income-producing years.

This mostly affects Baby Boomers, born between 1946 and 1964.

By now, debt should be reduced and kids might be flying solo…

Income should be well above expenses, as shown in the third section of the curve. This allows you to save and invest more and more, in preparation for later years. A nice trip could be a well-deserved reward.

During the managing years, you should progressively shift from wealth accumulation to wealth preservation. You have more money than time. This means that investments should slowly be less aggressive and more conservative.

4. The distributing years

Roughly after 77, most people are retired, which means that they need to live off of their savings and investments.

This mostly affects “The Greatest Generation,” born before 1945.

During that life stage, the earning curve drops, while spending remains significant, especially as medical needs increase.

There will be a point where active income is literally $0. This doesn’t have to be a scary situation as long as our affairs were planned correctly over the previous decades…

Financial well-being now depends on passive income and “wealth distribution.” This means transferring assets to heirs, beneficiaries, or charities.

This stage requires careful planning to ensure that someone’s assets are distributed in accordance with their wishes and that their loved ones are taken care of after they pass away.

During the distributing years, time is running out… If you planned well, you should have enough money to live on, and then some. Investment risk should be kept to a minimum.

Understanding the 4 stages is critical to properly plan your financial future. Each stage requires ever-evolving knowledge, strategies, and advisors for smart money management.

It’s also imperative to understand the changing nature of time through the 4 stages. Money is not the only thing that compounds. Time, wisdom, and good choices also compound.

By setting goals, creating a comprehensive plan, and fine-tuning your strategy, you can absolutely achieve your long-term financial goals and ensure a prosperous future.

And it all starts with financial education.

Phil Zeltzman, DVM, DACVS, CVJ, Fear Free Certified

Interested in learning more about $$$?

Subscribe to the Blog

Join the Community

Attend the Summit

Learn about the Mastermind