Our 1st Hot Stock Advice!

In our crazy new world, everything needs to be done remotely, including meetings, updates and simple conversations.

This online frenzy has led to a huge increase in webinars and teleconferences. One of the most popular platforms is Zoom.

Zoom is actually the technology we use for our interviews with financial experts. As a reminder, those videos are reserved for members of the Vet Financial Summit online community (you can sign up here).

Some investors, sniffing a good opportunity, jumped on the bandwagon and invested heavily in Zoom Technologies (“ticker” or stock symbol ZOOM).

This propelled the stock price from around $2 (where it basically hovered from October 2019 to mid-February 2020).

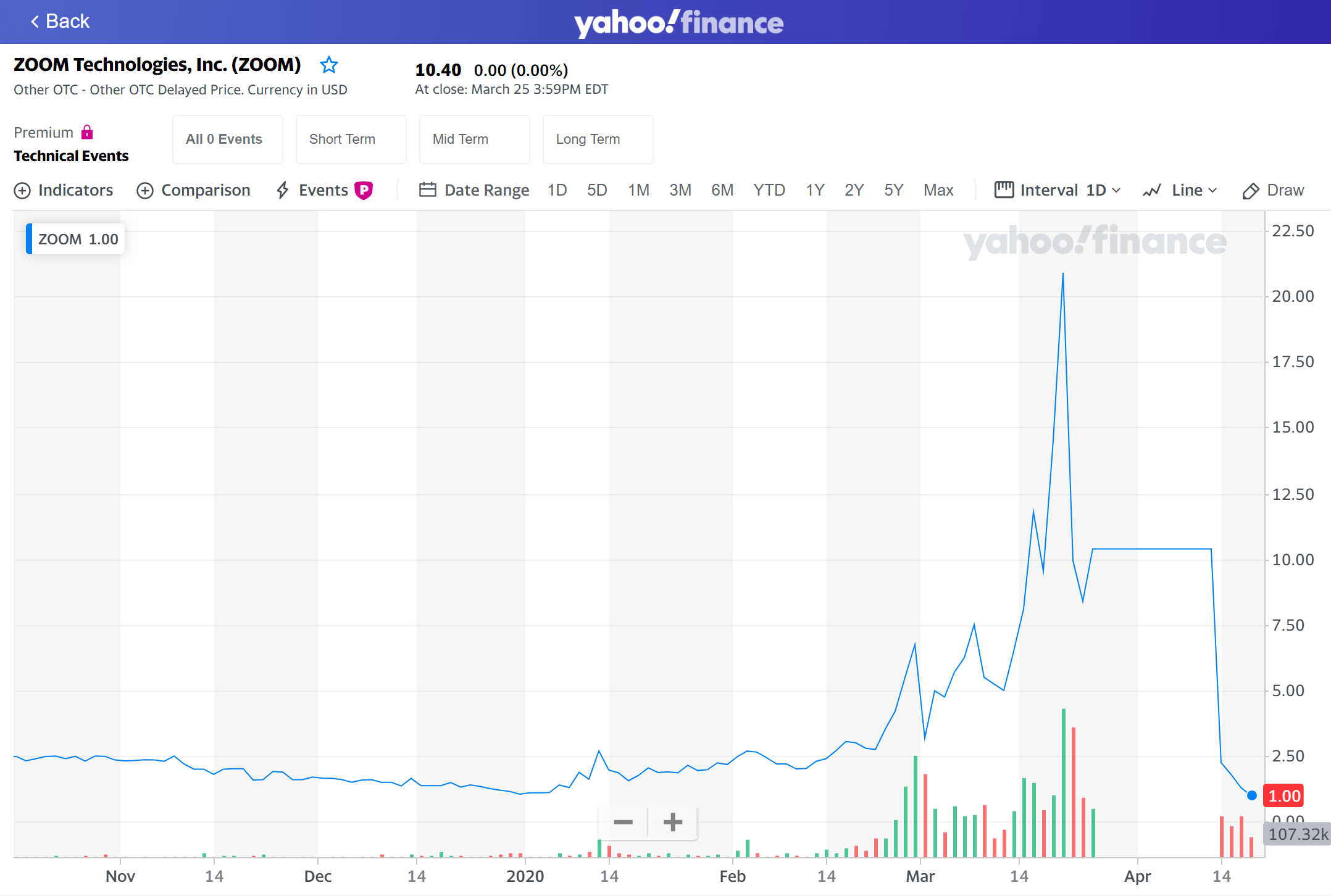

ZOOM Technologies stock price – many thanks to Yahoo! Finance.

If you’re new to investing, there is a lot you can learn from this stock chart:

- On the X (horizontal) axis is time.

- On the Y (vertical) axis is the stock price.

- The blue line is a visual representation of the stock price (Y) over time (X).

Nothing too complicated until now, right?

You may also notice green and red bars along the X axis. They represent the “volume” or activity for this stock. Few exchanges (buying or selling) mean a short bar. Many exchanges mean a taller bar. A stock frenzy means much taller bars, because many investors are buying up shares.

Sure enough, you can see few exchanges until mid-February 2020, pre-COVID.

This is when investors started to buy up Zoom. Activity went up (taller bars). And based on the law of supply and demand, Zoom’s price went up (crazy blue peak).

Can you imagine if you were one of the happy buyers in mid-February and early March 2020?

You could have bought Zoom at around $2, and by March 2020, the same stock would be worth over $20!

Let’s say you bought 1,000 shares at $2 on February 11. That’s enough to transform an initial investment of $2,000 (1,000 shares at $2 each) to the lovely sum of $20,900 (1,000 shares at $20.9 each) on March 20.

Would that make a difference in your life?

Clearly, this is rare in the investment world. Very few people can brag about similar returns in such a short period of time.

Isn’t it an amazing story?

Sadly, there is a big problem with our juicy story. Did you notice it?

The truth is… ZOOM Technologies, stock symbol ZOOM, has absolutely nothing to do with the “real” Zoom, the virtual meeting software we mentioned earlier.

They are two completely independent companies!

ZOOM Technologies, stock symbol ZOOM, is some obscure technology company, headquartered in Beijing, China. And yes, you can buy the stock on a US stock exchange platform (called the OTC, or Over-the-counter market).

Worse: according to the SEC (the U.S. Securities and Exchange Commission*), ZOOM Technologies has not made any public financial reporting since 2015!

Once the SEC realized what was happening, it stopped trading of ZOOM. The stock price cratered as you can see on the chart. Sadly, wannabe investors, depending on when they bought and when they sold, were left holding the bag.

Meanwhile, the real Zoom, Zoom Video Communications, stock symbol ZM, headquartered in San Jose, CA, did pretty well too…

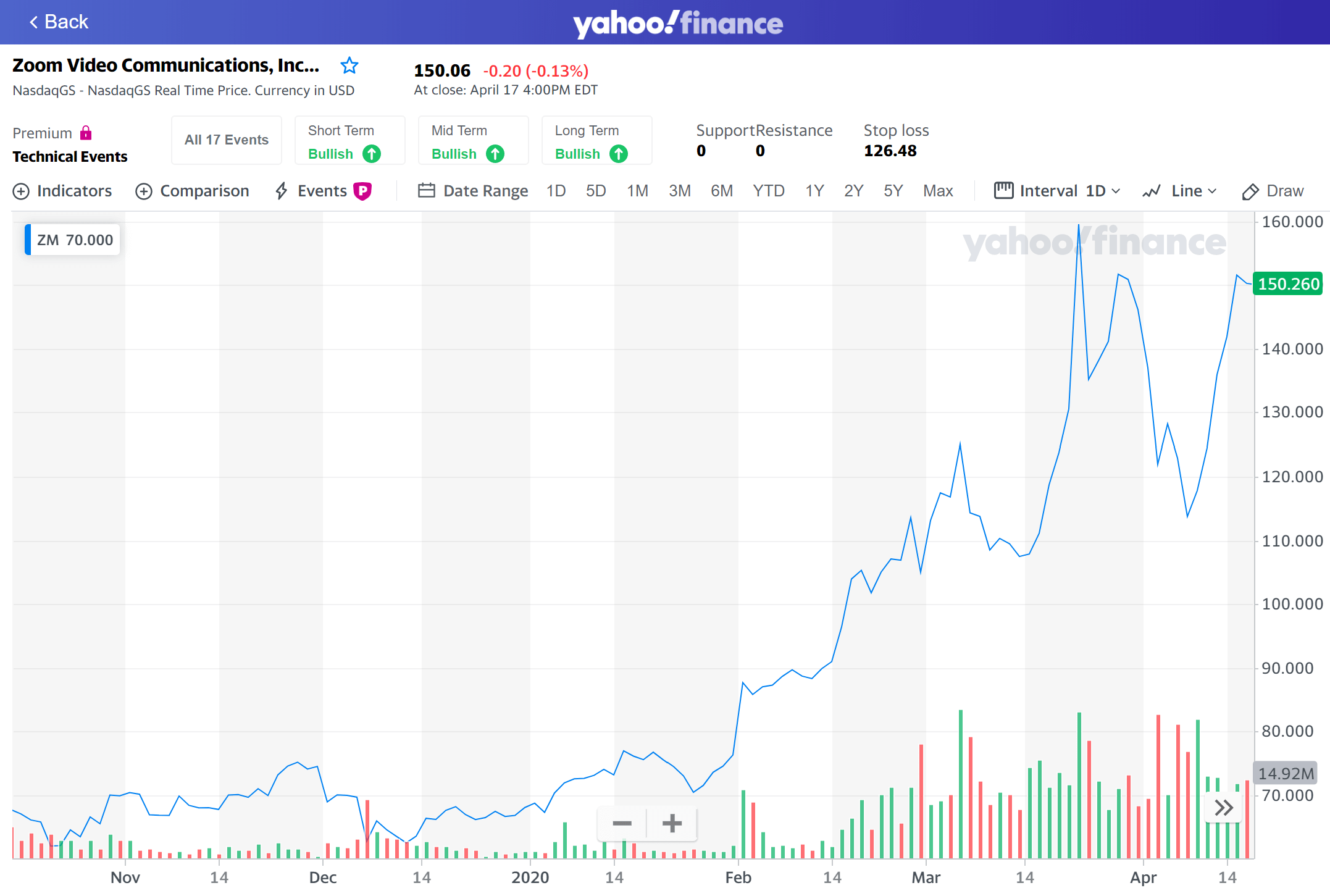

Zoom Video Communications stock price – many thanks to Yahoo! Finance.

In the same timeframe, ZM went from around $75 to roughly $150. That’s a double – not bad!

So should you buy ZM now? Nice try!

We are legally not allowed to make stock recommendations, so this will not happen.

So did we cheat in the title of this blog? Well, not really. OK, maybe a little.

The title is “Our 1st Hot Stock Advice!”

But our goal is not really to give you stock advice. Much more importantly, we want to show you how easily you can make a mistake by following a hot stock tip from your neighbor, your brother-in-law or your BFF. It’s a cruel but classic joke in the financial world.

The joke is the veterinary equivalent of pet owners taking medical advice from their groomer or their breeder. Don’t fall for it!

Stock market history is littered with similar stories:

- In 2002, investors got mixed up between the “real” telecom company MCI Communications (symbol MCIC) and MassMutual Corporate Investors (ticker MCI). Close, but different.

- In 2013, some confused investors bought Tweeter Home Entertainment (ticker TWTRQ), thinking they were buying social media company Twitter (TWTR). Different company, different spelling, different stock symbol. Tweeter spiked 1,500% during the day, then crashed.

- In 2014, Google announced its plan to purchase Nest Labs, a maker of thermostats. Investors rushed to buy NEST… sending shares up 1,900%. There was just one little glitch… NEST was the symbol for Nestor, a totally different, struggling penny stock.

You get the idea. If you want to invest in the stock market, you need to understand what you’re buying.

Don’t fall for hot stock tips.

Don’t give in to hot trends.

Don’t buy or sell on impulse.

It’s a classic investing trap.

Successful investors tend to be contrarians: they buy when most sell, and they sell when most buy.

Phil Zeltzman, DVM, DACVS

Meredith Jones, DVM

Co-Founders of Veterinary Financial Summit* The U.S. Securities and Exchange Commission (SEC) is an independent government agency responsible for protecting investors and maintaining orderly functioning of the stock market.

Interested in learning more about $$$?

Subscribe to the Blog

Join the Community

Attend the Summit

Learn about the Mastermind