Anatomy of a Bear Market (And Why You Should Care)

It’s brutal out there…

As of this writing (late May 2022), the Dow Jones Industrial Average is down 14% in 2022.

The Standard and Poor’s 500 is down 18% year to date.

And the NASDAQ has plummeted over 27%.

Walmart is down 17% (to date, not even annualized)*.

Apple is down 22% (ditto).

Google (sorry Alphabet) and Microsoft are down 25% (ditto).

Amazon is down 35% (ditto).

Facebook (sorry Meta Platform) is down 42% (ditto).

Zoom Video Communications is down 55% (ditto).

Netflix is down an amazing 69% (ditto).

I think you get the idea.

Clearly, we’re in a bear market, which by the official definition means that the “stock market” is down 20%.

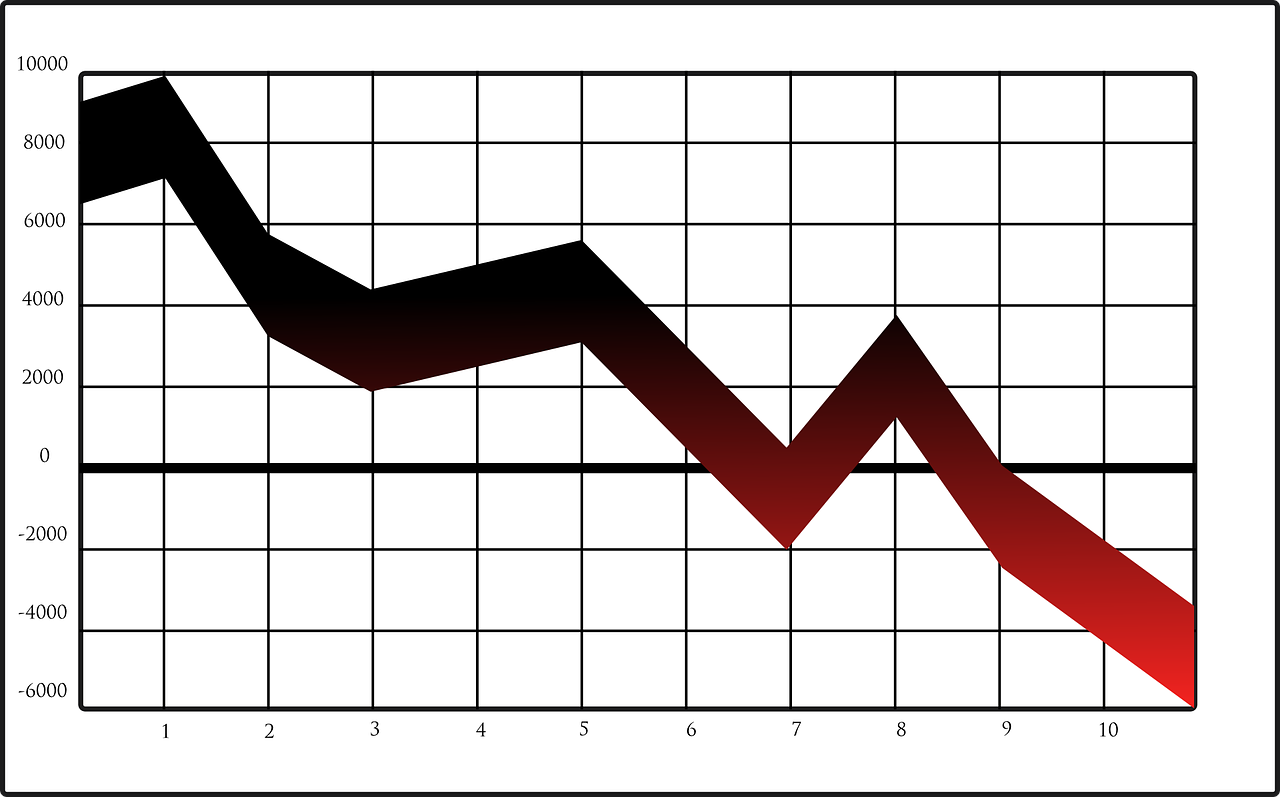

Bear markets tend to share the same patterns, no matter the time period, the country or the market.

They can usually be divided into 4 phases.

1. The initial decline. Typically, after a bull market, stocks start to drop. Because most investors were excited by their brilliant performance, they are caught by surprise.

2. The relief rally. This phase is tricky. For a variety of reasons, the market goes back up. So investors think the drop was not the beginning of a bear market but a mere correction, something that will pass. They think the worst is behind them. Yet it’s not true. They can’t know if it’s true at the time, and that’s the whole problem.

You may hear this phrase called the “dead-cat bounce,” a lovely expression that means that even a dead cat will bounce after falling from a great height.

3. The panic mode. Investors (big or small, individuals or giant funds) realize that the “correction” is not over yet. They sell their stocks based on emotions, not fundamentals. The more they sell, the more the market drops. It’s a painful vicious cycle. No sector is spared. There seems to be no end in sight.

As mentioned above, Netflix is down 69%. Annualized, that’s a 181% drop. That’s reason to panic if you own the stock!

4. The bottom. By then, investors have capitulated. They’ve reached a level of extreme pessimism. They lose faith in the stock market. Everybody knows they should buy low, but few people can pull the trigger during that phase.

It is useful to look at history to understand what typically happens during a bear market. Of course, history doesn’t always repeat itself, and bear markets don’t always behave exactly the same way. But it’s a good idea to understand the general concept to plan your investment strategy and not make huge mistakes that could force you to work until you turn 90…

Phil Zeltzman, DVM, DACVS, CVJ, Fear Free Certified

Interested in learning more about $$$?

Subscribe to the Blog

Join the Community

Attend the Summit

Learn about the Mastermind