Analyze Your Debt with the Cash Flow Index

How can you tell if each one of your debts is considered good debt or bad debt?

Intuitively, we know that credit card debt is bad.

We know that buying a couch on credit is bad.

But how about a mortgage? Car loans? Student debt?

Rather than relying on intuition, let’s look at an objective way to decide. Depending on the author, this concept is called the Cash Flow Index (CFI) or Liability Efficiency Ratio (LER).

This number is the result of a simple equation that helps you decide which loan should be paid off first because it hurts your cash flow the most.

Ready to play?

Step 1: Gather the last statement for each one of your loans.

This works for personal debt, including mortgage, car loan(s) and credit card balances.

And of course it works for professional debt, including student loans, practice loans, equipment loans, and a line of credit.

Step 2: The equation is simple:

Divide the total balance of the loan by the minimum payment.

So total balance / minimum payment = Cash Flow Index or Liability Efficiency Ratio for that loan.

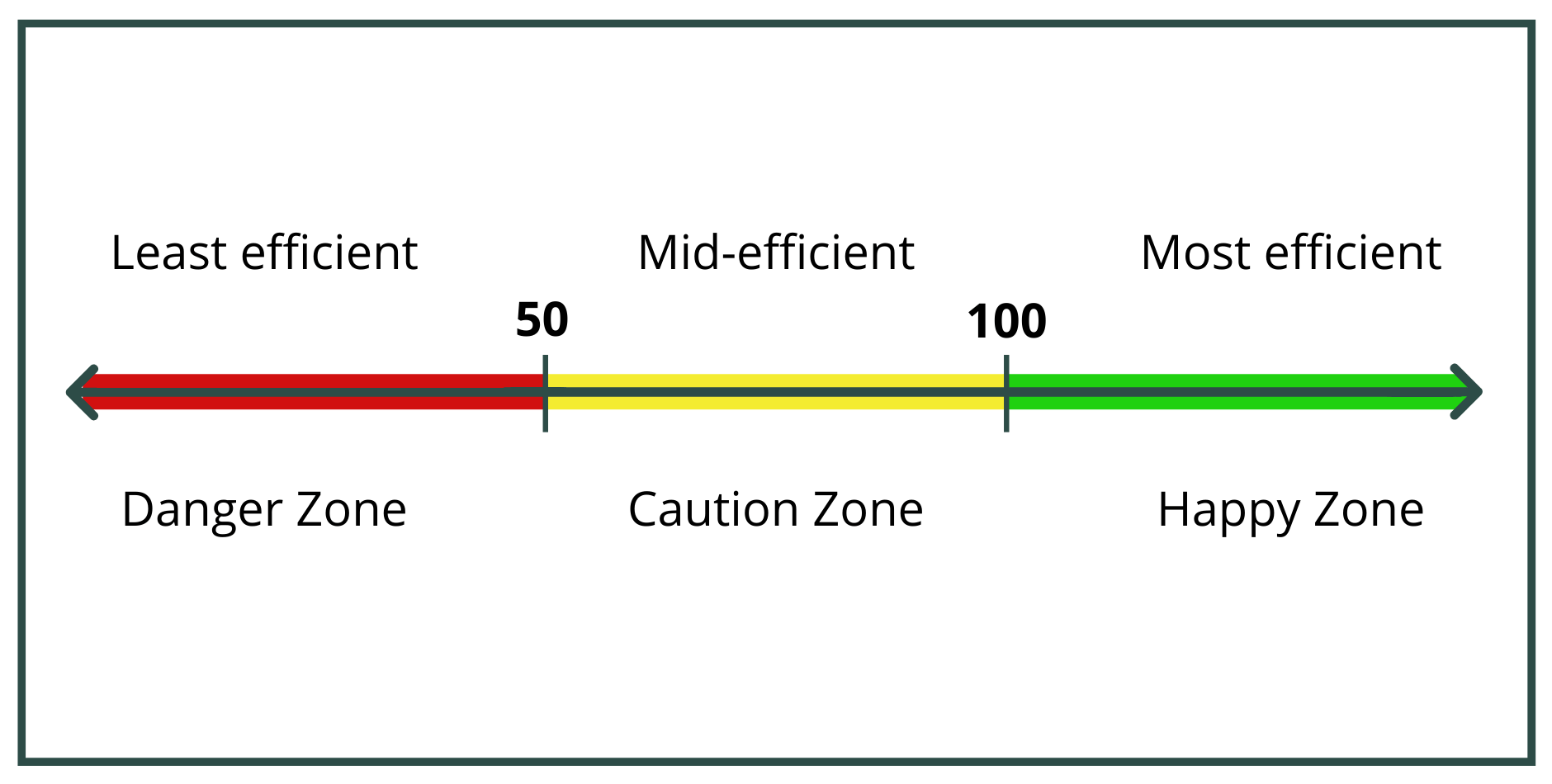

Step 3: See where your result falls along the scale.

– A cash flow index that falls under 50 is considered to be in the danger zone. This means it is a very inefficient loan and should be paid off ASAP.

– An index between 50 and 100 is considered to be in the caution zone. The urgency of repaying that loan falls somewhere in the middle of the bunch.

– An index over 100 is considered to be in the happy zone, meaning it is a very efficient loan and its repayment is a low priority.

Let’s take a few examples.

- Say you have a $150,000 mortgage with a monthly payment of $800. The cash flow index for that loan is 150,000/800 = 188.

- Then you have a car loan for $20,000 and your monthly payment is $500. Based on our equation, $20,000 / $500 = 40.

- How about a small student loan for $60,000 with a monthly payment of $800? The math says that $60,000 / $800 = 75.

What does this all mean?

Now you can see that the car loan (cash flow index of 40) is under 50, which means it’s a poorly efficient loan and it should be paid off ASAP.

Your student loan has a cash flow index of 75, which falls in the mid-efficient zone, so that loan is not super efficient, but it’s also not the worst possible debt.

Your mortgage has a cash flow index of 188, which makes it a very efficient loan. Not even taking the tax benefits into consideration, this is the loan you can consider keeping (and not paying early).

You will notice that nowhere in this discussion did we mention the interest rate for each loan. This is the fascinating point about the Cash Flow Index: the interest rate is irrelevant – even though many novice investors focus only on that.

Sophisticated investors focus on the efficiency of their loans.

They avoid bad debt and prefer good debt.

Now you can be part of the sophisticated crowd.

Phil Zeltzman, DVM, DACVS

Meredith Jones, DVM

Co-Founders of Veterinary Financial Summit

Interested in learning more about $$$?

Subscribe to the Blog

Join the Community

Attend the Summit

Learn about the Mastermind