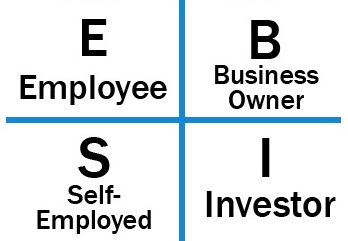

A Critical Concept: The Cashflow Quadrants

Many “money geeks” say that best-selling author Robert Kiyosaki played a big part in their financial education. Several of his books, such as “Rich Dad, Poor Dad,” are must-read.

In another one of his classic books, “Rich Dad’s Cashflow Quadrant: Guide to Financial Freedom,” Kiyosaki writes: “The main reason people struggle financially is because they have spent years in school but learned nothing about money. The result is that people learn to work for money… but never learn to have money work for them.”

If you can relate to this, learn from Kiyosaki’s concept of the 4 groups of people in the workforce. They correlate with 4 main ways to make money. They answer the question: “What would happen to your finances if you went on a vacation for a month?”

Employee

As an employee (quadrant E), you work for someone else. You receive a regular paycheck. You are a W2 wage earner. Most people are paid this way. Taxes are taken out automatically from each paycheck before you ever get the paycheck.

You are in one of the highest tax brackets, based on your earnings, because the IRS considers that you don’t contribute much to the economy. Most people start out this way. The problem is, if you don’t work, you don’t earn money. The only exception may be a 2 week vacation that is paid for by your employer. As an employee, you exchange time, effort and knowledge for money.

Self-Employed

If you are self-employed (quadrant S), you may call yourself a business owner. In reality, you really own a job. In our world, you may own a veterinary practice, but it typically doesn’t run without you. You may make more money than you did as an employee, but the business depends heavily on you. You likely don’t work 40 hours per week. You may easily work 60 or 80 hours a week, including nights and weekends. You have to be present for the practice to run. When you’re not there, little to no money is made.

One advantage of being self-employed is that there are several tax benefits. For example, you are taxed after expenses are taken off your earnings. In some cases, you may be able to take advantage of depreciation on equipment you purchased. You receive an automatic tax deduction over several years because your equipment purchase helps stimulate the economy. Still, you are exchanging time, effort and knowledge for money.

Whether you are an employee or self-employed, you are an active worker. You earn what is called active income. You work for money. Of course, there is nothing wrong with being an employee or self-employed. The economy would not function without these two categories in the workforce. The point is certainly not to imply that everybody should be in the next two categories. The point is to be aware of the difference in mentality.

Business Owner

By Kiyosaki’s definition, as a business owner (quadrant B), you own a business, but you are no longer needed for the business to run. So you now own an asset that generates money for you, and your presence is not required anymore. If you went on a vacation for a month, the business would continue to run smoothly.

Investor

Similar to a business owner, an investor (quadrant I) is not exchanging time for money. In addition, there are some tax advantages depending on the type of investment you make. You may now pay taxes on capital gains, or dividends, in a lower tax bracket. In some cases, you can also benefit from depreciation, which is an important tax benefit.

Whether you are a business owner or an investor, you earn what is called passive income. Your money now works for you. Clearly this is radically different from being an employee or self-employed, who are active workers.

Which Quadrant Do You Want to Be In?

Kiyosaki doesn’t mince words and strongly encourages the reader to transition from the E or S quadrant to the B or I quadrant.

What can you do if you are an employee? Short of launching or buying a business, you can invest some of your earnings in cash flowing investments and become an investor. You don’t necessarily have to be present for the business to run. And you can benefit from tax cuts.

If you are self-employed, you can work toward creating a business that is increasingly less dependent on you. If you are a practice owner, you need to hire associates to take care of clients and patients when you are not present. You need to slowly phase yourself out of the practice over time. Because the practice does not rely on you, you are turning your business into a true asset that someone may want to buy one day.

Reading Kiyosaki’s “Cashflow Quadrant” book will change your mindset. It’s a great place to start your financial education.

Phil Zeltzman, DVM, DACVS

Meredith Jones, DVM

Co-Founders of Veterinary Financial Summit

Interested in learning more about $$$?

Subscribe to the Blog

Join the Community

Attend the Summit

Learn about the Mastermind